Between Last holding until now, KLCI once reached its height at 1810 pt on 24th July 2013. However, worrying that US Federal reserve may tap Quantitative Easing (QE) soon, foreign capital start flowing out of emerging market, thus bringing KLCI back to 1720++ level. News of possible military action by US against Syria Assad Government further sent the market down to 1660++ level, where the market recovered only these few days.

The fluctuation of stock price is emotionally driven rather than fundamentally driven. Thus, when investor's fear prevail, it would be a good time to enter the market and pick some good stock. However, this opportunity window is very short, where local fund will keen on exploiting it hence providing support to price level.

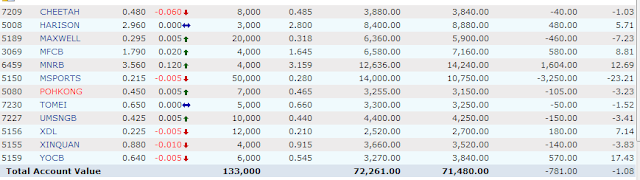

Current Return and performance

The holding period return for KLCI in the past period ( 1st July - 31st August 2013) is -2.03% (with dividend included). Holding Period return for my portfolio, is -2.37%. Total holding period return for my first year of investing is -1.34%. Which is way below the Fixed Deposit rate of 3.2-3.8%, or KLCI return of 8.77%.

The bad performance could be attributed to few of the bad picks at the beginning of my investment. They are Jewellry Company's (Pohkong and Tomei) which suffered badly when gold price drop significantly during the year, non-performing company like RCE-Capital, "red chips" like Maxwell, Msport, XDL that saw their price depressed even though their P/E ratio (less than 3), cash level (higher than current market capitalization) remain attractives.

Things should get better as my current portfolio is more diversify now, holding some potential stocks like YOCB, MNRB, MFCB and Harrison. Figure below listed a summary of stocks that i currently hold.

New Members

Cheetah & UMSNGB have the same characteristics, their earning remain stable, ROE and ROIC around 10%, but price is below NAV per share. I believe this kind of stocks have the good chance to track/beat the market while enjoying lower downside risk. However, as general market still in fairly price/overprice region, it become increasingly rare to find the potential picks at bargain price.