I am writing this up because there is no direct comparison of the credit cards available in Malaysia. This is due to the fact that:

For example, the Ringgit Plus Website listed up to 7 credit cards for Best Travel Credit Cards for All Income Bands (here), and 5 credit cards for Air Miles Credit Card In Malaysia (here). However, both articles failed to do a holistic comparison of what the consumer stand to gain based on his/her consumption pattern, accounting for different cashback/points earning criteria and cap, the value of the rewards between cashback and treat points for different reward programs and considerations of other charges (such as foreign currency conversion fee).

For the start, lets quickly go through a few of the general rules regarding the credit cards in Malaysia,

Rule 1: For Credit Cards focus on cashback, Credit Card that advertised a higher cashback rate usually has a stringent criterion (in the form of minimum spending) and Cap on the amount that you can earn.

For example, Standard Charter Just One Platinum MasterCard advertises a cashback rate as high as 15% for grocery, dining and online transaction. However, you need to spend a total of RM 2,500 per month to earn 15%, and the total cashback for the three categories combined is RM60 only. The rest of the spend will only earn a meager 0.2%. Now if you spend a total of RM 2,500 per month, with RM 400 on the three categories that are entitled to 15% cashback,

How much is your total cashback? Estimate RM 64.2

How much is your actual cashback rate? around 2.568%

And the drawback is, any amount you spend above the RM 2,500, will only earn you 0.2% cashback now.

Rule 2: For Credit Cards that focus on points, usually redeeming points into Airmiles will give you better value. However, be aware of the conversion rate and cap.

Take HSBC Visa Signature, for example, on paper, it sounds really good with high conversion rate to Airmiles, where it earns 8X rewards point for shopping in foreign currency, 5X reward point on online shopping and 5X reward point on participating malls, which can be effectively converted to Enrich miles at the rate of 18:1.

- all the credit cards have different cashback/ points earning mechanisms and limitation that I believe was designed to confuse the consumers so they are harder to choose from,

- the credit card points earned between different banks also valued differently,

- there is very little attempt by the credit card comparison articles/websites to compare the credit cards available based on the consumption pattern of the consumers

For example, the Ringgit Plus Website listed up to 7 credit cards for Best Travel Credit Cards for All Income Bands (here), and 5 credit cards for Air Miles Credit Card In Malaysia (here). However, both articles failed to do a holistic comparison of what the consumer stand to gain based on his/her consumption pattern, accounting for different cashback/points earning criteria and cap, the value of the rewards between cashback and treat points for different reward programs and considerations of other charges (such as foreign currency conversion fee).

For the start, lets quickly go through a few of the general rules regarding the credit cards in Malaysia,

Rule 1: For Credit Cards focus on cashback, Credit Card that advertised a higher cashback rate usually has a stringent criterion (in the form of minimum spending) and Cap on the amount that you can earn.

For example, Standard Charter Just One Platinum MasterCard advertises a cashback rate as high as 15% for grocery, dining and online transaction. However, you need to spend a total of RM 2,500 per month to earn 15%, and the total cashback for the three categories combined is RM60 only. The rest of the spend will only earn a meager 0.2%. Now if you spend a total of RM 2,500 per month, with RM 400 on the three categories that are entitled to 15% cashback,

How much is your total cashback? Estimate RM 64.2

How much is your actual cashback rate? around 2.568%

And the drawback is, any amount you spend above the RM 2,500, will only earn you 0.2% cashback now.

Rule 2: For Credit Cards that focus on points, usually redeeming points into Airmiles will give you better value. However, be aware of the conversion rate and cap.

Take HSBC Visa Signature, for example, on paper, it sounds really good with high conversion rate to Airmiles, where it earns 8X rewards point for shopping in foreign currency, 5X reward point on online shopping and 5X reward point on participating malls, which can be effectively converted to Enrich miles at the rate of 18:1.

However, there is a catch. There is a cap of 15,000 rewards points per category per month. Once you reach the cap, there is only 1X reward point for shopping in foreign currency, online shopping, and participating malls. For example, if you spend RM 6,000 abroad, the actual reward points you get is only 21,000 points, which give you only 1167 enrich miles, a meager rate of 0.19 miles per RM spent.

Rule 3: For overseas spend, beware of Foreign Currency Conversion Charge,

For example,

AMEX Card network charge is typically 2.5% (here)

For Visa Card & Master Card: Typical Typical network charge is 1.25% + Bank administrative charge of 1% (here)

So far the only two banks/financial institutions that I knew which currently don't levy bank administrative charges are public bank and Big pay.

And according to this post, Master Card had a slightly better foreign currency conversion rate (here)

Now before we start the comparisons, there is still one important question left, how to compare credit card points earned vs cashback credit card?

One quick way out is to use the amount of Airmiles earned as a benchmark as the Airmiles are usually of better value compared to other points redemption options. I have tried to establish the value of Enrichmiles and Krisflyermiles here. There are also few articles that discussed the value of Enrichmiles (see here) and Krisflyer miles (see here and here). For the sake of convenience lets just assume each Enrichmiles worth at least RM 0.036 and each Krisflyermiles worth at least RM 0.038.

One quick way out is to use the amount of Airmiles earned as a benchmark as the Airmiles are usually of better value compared to other points redemption options. I have tried to establish the value of Enrichmiles and Krisflyermiles here. There are also few articles that discussed the value of Enrichmiles (see here) and Krisflyer miles (see here and here). For the sake of convenience lets just assume each Enrichmiles worth at least RM 0.036 and each Krisflyermiles worth at least RM 0.038.

For AirAsia Big Points, the value is fixed around RM 0.01.

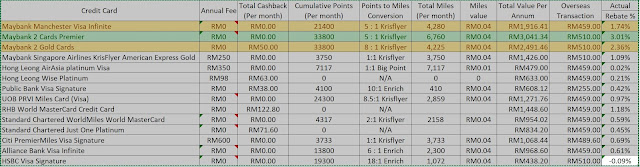

Let's start to look at the results

Spending Pattern One (the budget guy)

Annual Spend around RM 30,000

Monthly spending breakdown:

Monthly spending breakdown:

Petrol : RM 225

Dining: RM 1,000

Groceries: RM 225

Other Retail Purchase: RM 625

Utilities, Insurance Payment : RM 150

Other Online Transaction: RM 175

Flights Ticket (Average per month) : RM 100

Flights Ticket (Average per month) : RM 100

No oversea spending

Assuming all flights using Airasia

The best credit card? Maybank 2 Gold Cards (Assuming you can swipe with AMEX with a total of RM 1000 during weekend).

Best alternative? Standard Chartered Just One Platinum

Spending Pattern Two (the typical family)

The best credit card? Maybank 2 Gold Cards (Assuming you can swipe with AMEX with a total of RM 1000 during weekend).

Best alternative? Standard Chartered Just One Platinum

Spending Pattern Two (the typical family)

Annual Spend around RM 60,000

Monthly spending breakdown:

Monthly spending breakdown:

Petrol : RM 400

Dining: RM 2,000

Groceries: RM 1000

Other Retail Purchase: RM 600

Utilities, Insurance Payment : RM 300

Other Online Transaction: RM 500

Flights Ticket (Average per month) : RM 200

Flights Ticket (Average per month) : RM 200

No oversea spending

Assuming all flights using the specific airlines of the credit card (Like Airasia for Hong Leong Airasia Platinum)

The best credit card? Still Maybank 2 Gold Cards (Assuming you can swipe with AMEX with a total of RM 1000 during weekend).

Next alternative? Standard Chartered Just One Platinum or RHB World Master Card

Spending Pattern Three (the typical family with annual oversea trips)

The best credit card? Still Maybank 2 Gold Cards (Assuming you can swipe with AMEX with a total of RM 1000 during weekend).

Next alternative? Standard Chartered Just One Platinum or RHB World Master Card

Spending Pattern Three (the typical family with annual oversea trips)

Annual Spend around RM 84,000

Monthly spending breakdown:

Monthly spending breakdown:

Petrol : RM 400

Dining: RM 2,000

Groceries: RM 1000

Other Retail Purchase: RM 600

Utilities, Insurance Payment : RM 300

Other Online Transaction: RM 500

Flights Ticket (Average per month) : RM 500

Oversea spending (Average out per month) : RM 1700

Flights Ticket (Average per month) : RM 500

Oversea spending (Average out per month) : RM 1700

Discussion & Afterthoughts:

As you may see, when your total annual spending increase, the cashback credit card starts gaining fewer values due to the cashback cap per month. And among all the Airmiles cards, Maybank's Visa Infinite or equivalent and Maybank 2 Cards Premier start to stand out among others.

It is worth noting that, as AMEX charges a higher foreign currency conversion charge compared to a visa card, hence the higher the potion of your oversea expenditure, it may be better to use Maybank Visa Infinite or equivalent instead. Plus, AMEX is actually less acceptable in overseas.

There is few special card - one of it is Public Bank Visa Signature, that offers 6% cash back on groceries, dining and online transaction without minimum spending requirement, but capped at RM 38 per month. One can actually spend on groceries, dining and online transaction till about RM 633 per month on Public Bank Visa Signature, before charging the rest of the expenditures on other cards.

Another card is Public bank quantum master/visa, which offer 5% cash back capped at RM 30 per month for online/contactless purchase.

Let me know which other cards you like to see for comparison or which other spending patterns you like to use.

As you may see, when your total annual spending increase, the cashback credit card starts gaining fewer values due to the cashback cap per month. And among all the Airmiles cards, Maybank's Visa Infinite or equivalent and Maybank 2 Cards Premier start to stand out among others.

It is worth noting that, as AMEX charges a higher foreign currency conversion charge compared to a visa card, hence the higher the potion of your oversea expenditure, it may be better to use Maybank Visa Infinite or equivalent instead. Plus, AMEX is actually less acceptable in overseas.

There is few special card - one of it is Public Bank Visa Signature, that offers 6% cash back on groceries, dining and online transaction without minimum spending requirement, but capped at RM 38 per month. One can actually spend on groceries, dining and online transaction till about RM 633 per month on Public Bank Visa Signature, before charging the rest of the expenditures on other cards.

Another card is Public bank quantum master/visa, which offer 5% cash back capped at RM 30 per month for online/contactless purchase.

Let me know which other cards you like to see for comparison or which other spending patterns you like to use.

No comments:

Post a Comment