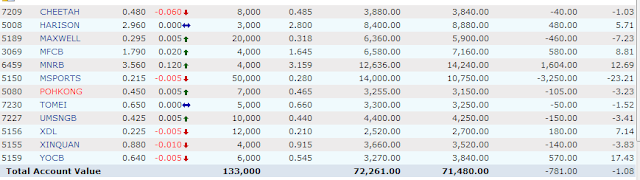

A quick comparison, this is the old rate.

Below is the new rate,

The revised figure represent an 25%- 60% increase of the old rate. Some critics say that, the effective new rate is actually locking up the members capital, hence preventing them for realizing higher potential for the savings. One of the critique even says that, if Nobel Foundation was to act as EPF, they will ceased to be exist today. (See here) or picture below.

But is it true to their claim? I'm afraid not.

First , we can try to check the performance of Nobel Foundations.

Their annual report can be viewed here, In 2012, they earned a total of SEK 30.456 million for total equity of SEK 2860.9, this represent a return of........1.1%!

Incontrast, EPF declared a dividend of 6.15% for 2012, which is comparable to Amanah Saham National Berhad's fund distribution between 6.00%- 6.70%. And their return is less volatile than some of ASNB's fund. For example, in year 2008 during World financial crisis, EPF declared distribution of 4.5% while Amanah Saham National Scheme Fund report a return of -34% (source, ASNB annual report 2012).

We need to understand that,

1. There is no free lunch in the world, higher return came with higher risk. Especially when we invest in equity.

2. The main objective of EPF is to safeguard the member's saving for retirement. Growing the fund within the risk constraints, is their second objective. Hence, chasing higher return by taking much higher risk, is against their principal.

3. With roughly 40% invested in equity, 20% invested in overseas (see here) , EPF holds a much balanced and diversified portfolio than any other unit trust in Malaysia can provide. In investment world, a balanced and diversified portfolio is much safer, while have a potential of earning return near equity level.

4. And not to mention, EPF overhead expense is less than 0.2% of total assests, where most of the private unit trust in malaysia charged around 1.5% for assest management fees.

5. Last but not least, even if the members can withdraw earlier, how many of them, have the skill of Warren Buffets to outrun the investment professional in the long term? How many of them , will actually loose their savings in stock market frenzy?

As conclusion,

The above measure is not that bad, after all.