The market went through a bumpy road for the past month. News like MH370 went missing and Crimea referendum to join Russia periodically shock the market and creating buying opportunity for investors. However, over the long run, strong recovery in US and Europe and slowing down of China Economy will be two opposite theme that shape the future of the market.

Current Return and performance

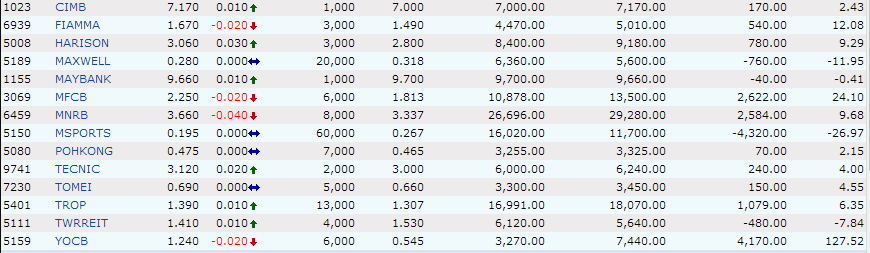

The holding period return for KLCI in the past period (1st March 2014 - 30th March 2014) is 1.09% (with dividend included). Holding Period return for my portfolio, is -0.50%. Total holding period return for my portfolio since the inception is 10.76%, annualized to be 6.66%, this is significantly above the Fixed Deposit rate of 3.2-3.8%, but still way below KLCI return of 18.78% (annualized, 11.48%).

Trading Activities

Addition of CIMB (1023) and Maybank (1155), Banking would be the sector that have least chance of going out of business. At low P/E (12- 13) and high yield (approx 3.5% for CIMB and 6% for Maybank), the price seems attractive for me.

No comments:

Post a Comment